donor advised funds

Realize your philanthropic goals and achieve your financial planning priorities with a donor advised fund.

why start a donor advised fund?

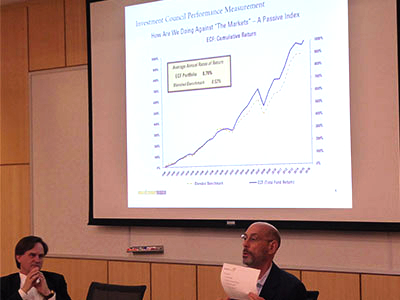

Establishing a donor advised fund enables you to manage the timing of your charitabl e gift – and the related tax benefits – while retaining the ability to recommend distributions to the organizations of your choice over time. You can continue to support the organizations you know well and/or expand your giving by working with the Foundation's staff to identify grantees that align with your interests. Many of our donor advised funds participate in ECF's grants as grantmaking partners, evaluating funding opportunities from among the grant proposals vetted by our grant committees. The 1% annual fund fee supports ECF's work for the good of Evanston.

e gift – and the related tax benefits – while retaining the ability to recommend distributions to the organizations of your choice over time. You can continue to support the organizations you know well and/or expand your giving by working with the Foundation's staff to identify grantees that align with your interests. Many of our donor advised funds participate in ECF's grants as grantmaking partners, evaluating funding opportunities from among the grant proposals vetted by our grant committees. The 1% annual fund fee supports ECF's work for the good of Evanston.

getting started

The minimum balance to open or maintain a donor advised fund is $10,000. We will draft a simple fund agreement and arrange to receive your gift to establish the fund.

A donor advised fund may be permanently endowed — managed for long-term growth while generating an annual distribution — or spent down according to your timetable.

Please email Cynthia Dominguez, Vice President of Finance and Operations, or call us at 847.492.0990 for more information.

for your fund

We'll want to know the initial amount of your gift and whether you'll contribute cash or securities - many donors increase their tax benefit by using appreciated stock to start their funds. What name will you give your fund? Who will advise the Fund? Should you become unable to advise the Fund, where should the Foundation deposit any remainder? Popular choices include the Fund for Evanston or a field of interest fund.

donor advised funds of the Evanston Community Foundation

View the Fund List page for the listing of all donor advised funds.